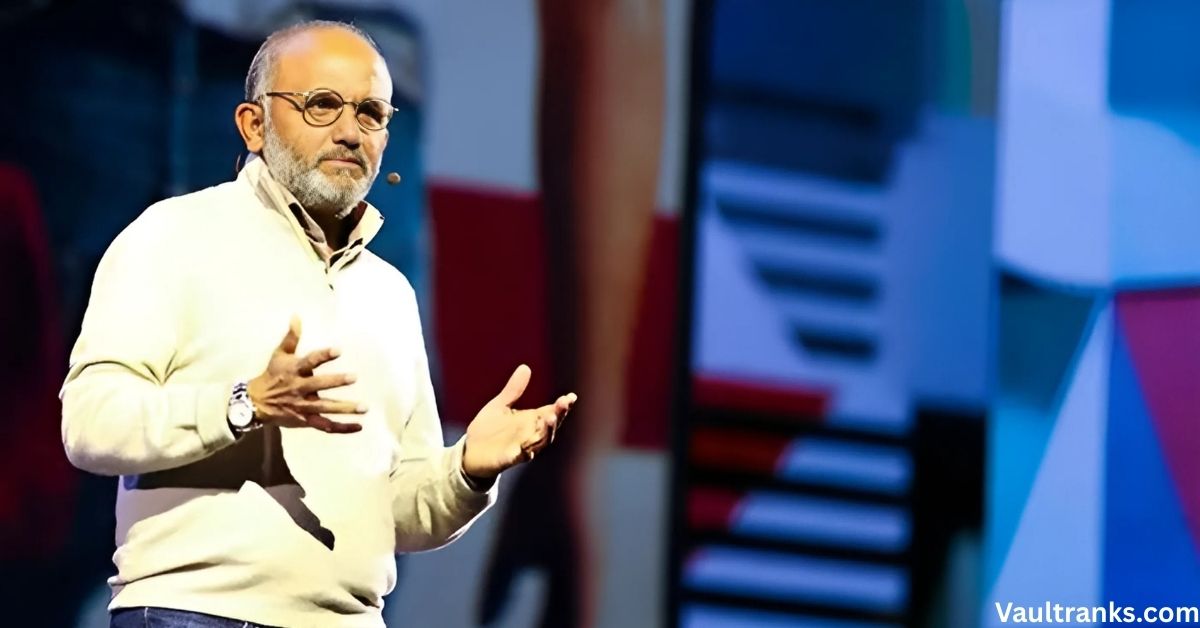

Shantanu Narayen is the Chair and CEO of Adobe Inc, a global software company best known for products like Photoshop, Illustrator, and Acrobat. He has held this role since 2007 and has significantly contributed to the company’s rise in value. As of 2025, Shantanu Narayen net worth is estimated to be over $137 million, based on his stock ownership, executive compensation, and insider transactions. The majority of his wealth comes from ADBE shares, along with regular stock options awarded by the company.

According to public SEC filings, he owns more than 137,094,202 shares in Adobe Inc. His trading activity and financial disclosures can be tracked using tools like GuruFocus and the SEC Insider Trading Tracker, which help investors monitor high-level executive actions. His insider trading history, including multiple Form 4 submissions, shows consistent activity in buying and selling shares, with many of those trades aligning with Adobe’s performance milestones. These filings give a clearer picture of how his net worth has grown steadily alongside Adobe’s rise.

Shantanu Narayen Profile Summar

| Attribute | Details |

| Full Name | Shantanu Narayen |

| Current Role | Chairman & CEO, Adobe Inc. |

| Net Worth (2025 Estimate) | $137 Million+ |

| Company Affiliation | Adobe Inc (ADBE) |

| Board Memberships | Director, Pfizer Inc (PFE) |

| Total ADBE Shares Owned | 137,094,202 |

| Recent Stock Sale | 7,654 shares @ $382.98 (May 6, 2025) |

| Form 4 Filings | Multiple, ongoing (publicly available via SEC) |

| Primary Industry Focus | Software (Creative & Document Cloud, AI, Digital Media) |

| Other Industry Exposure | Healthcare (via Pfizer Inc) |

| 2024 Compensation | $25+ Million (Salary, Bonus, Equity Grants) |

Transaction Summary of Shantanu Narayen

A review of Shantanu Narayen’s insider transactions reveals a series of strategic stock sales and occasional purchases over the years. The most recent Form 4 filing, dated 2025-05-06, shows that he sold 7,654 shares of ADBE at a price of $382.98, totaling over $2,933,369. Each of these transactions is publicly reported, ensuring transparency.

Earlier trades show similar activity. For instance, on 2024-09-25, he sold 4,000 shares at a slightly lower price point. These buy and sell actions are typically part of pre-scheduled trading plans, not sudden market moves. His consistent ownership of core shares shows that while he takes profits, he remains heavily invested in Adobe’s long-term growth.

Read This Also: Stacey Bendet Net Worth: The Remarkable Rise to Success

Shantanu Narayen Insider Ownership Reports

Shantanu Narayen’s insider ownership reports show that he is one of the largest individual shareholders at Adobe Inc. With over 137 million shares owned, his stake represents a major influence in the company’s direction. These ownership reports are filed with the SEC and provide insights into how much control top executives have in public companies.

Ownership is not just about shares. It’s also about voting power, strategic direction, and alignment with investors. Narayen’s executive role, combined with his stock holdings, makes him a key figure to watch. His reports, especially those submitted via Form 4, help analysts and retail investors track how insiders like him manage their wealth.

Insider Ownership Summary of Shantanu Narayen

In summary, Shantanu Narayen holds a strong ownership position at Adobe Inc. The most recent ownership summary reveals that he maintains long-term holdings and is not merely engaged in short-term trading. This strategy shows his belief in Adobe’s sustained success.

His insider ownership is regularly updated in systems like GuruFocus, and his holdings usually fluctuate slightly due to scheduled sales. However, his core shares owned remain stable, and there has been no large-scale divestment, which often signals a shift in company outlook.

Shantanu Narayen Latest Holdings Summary

Shantanu Narayen’s latest holdings summary includes his large stake in Adobe Inc, with the value exceeding several hundred million dollars. His current price basis and market value keep increasing, reflecting Adobe’s strong stock performance.

These holdings also reflect his belief in Adobe’s future. He hasn’t significantly diversified into other companies recently, although his position as a director at Pfizer Inc gives him exposure to other industries, such as pharmaceuticals.

Latest Holdings of Shantanu Narayen

According to the latest reports, Narayen holds 137,094,202 shares of ADBE, worth approximately $382.98 per share. His total holding value is massive, especially when considering the price per share and Adobe’s consistent performance in the tech sector.

He does not hold a large number of shares in other companies, though he does sit on Pfizer Inc’s board. These latest holdings are closely watched by analysts, as they often reflect an executive’s confidence in the company they lead.

Holding Weightings of Shantanu Narayen

The majority of Narayen’s holding weightings fall under Adobe Inc, reflecting his long-term commitment to the company. There’s minimal diversification, and almost 100% of his net worth is tied to Adobe.

Charts tracking his ownership show that while many executives spread their holdings, Narayen has stayed focused. This could either show confidence or potential risk if Adobe faces any downturn. However, so far, the performance has been strong.

Shantanu Narayen Form 4 Trading Tracker

A detailed Form 4 Trading Tracker provides historical data of Shantanu Narayen’s stock transactions. These records include buy, sell, and ownership updates. Filed with the SEC, each Form 4 entry contains the number of shares, the transaction date, the price, and the resulting balance.

From these trackers, we see trades like the 19,457 shares sold in early 2024 and 2,500 shares in mid-2023. Such data is used by both retail and institutional investors to detect patterns in insider trading.

Insider Trading History of Shantanu Narayen

Shantanu Narayen’s insider trading history stretches over a decade. His sales typically occur in predictable cycles, suggesting scheduled transactions. He’s also made a few purchases, though these are less common.

All activity is publicly available through GuruFocus and SEC archives. Analysts often use this data to measure how well executives time the market. In Narayen’s case, his trades generally align with Adobe’s strong financial reporting periods.

Shantanu Narayen Trading Performance

His trading performance has been effective. Most of his sell transactions have occurred near stock price peaks, which implies excellent timing. This may be due to his deep understanding of company cycles.

Though he doesn’t engage in rapid trading, his long-term holding performance has significantly boosted his net worth. Investors often cite his disciplined approach as a model for other tech leaders.

Shantanu Narayen Ownership Network

Shantanu Narayen’s ownership network includes Adobe insiders and board members from Pfizer Inc. These connections form a strategic web of influence across tech and healthcare industries.

For example, he works alongside Ronald E Blaylock, Scott Gottlieb, and Payal Sahni at Pfizer, and with Scott Belsky, Daniel Durn, Jennifer B. Damico, and Mark S. Garfield at Adobe. These relationships help him stay connected to innovations and executive strategies.

Ownership Network List of Shantanu Narayen

The ownership network list includes Adobe’s top leadership like Scott Belsky (Chief Product Officer), Daniel Durn (CFO), Jennifer B. Damico (CAO), and Mark S. Garfield (Corp Controller). At Pfizer Inc, he interacts with Christoffel Boshoff and Payal Sahni.

These executives each have deep industry experience. Narayen’s ties with them allow him to influence broader market directions beyond just Adobe.

Ownership Network Relation of Shantanu Narayen

Narayan’s network relations are built through mutual board memberships and corporate leadership. His role at Pfizer connects him to leading healthcare experts like Scott Gottlieb and Ronald E Blaylock. His Adobe team complements that with deep software and tech experience.

This blended network gives him insights into multiple industries. It also strengthens investor confidence because of the support system of highly skilled executives around him.

Shantanu Narayen’s Compensation Overview

Shantanu Narayen receives a competitive compensation package that includes base salary, bonuses, and stock options. For 2024, his total compensation was over $25 million, mostly from equity grants.

Compared to other S&P 500 tech CEOs, his pay is well-aligned with Adobe’s performance. The compensation structure aims to reward long-term shareholder value, which is reflected in his large stock holdings.

Shantanu Narayen Owned Company Details

Apart from Adobe, Shantanu Narayen does not publicly own other companies. However, his board position at Pfizer Inc shows his interest in healthcare. His profile remains focused on corporate leadership rather than personal startups or private companies.

All his roles involve deep engagement in strategy, innovation, and operational excellence, whether at a tech company like Adobe or a pharmaceutical giant like Pfizer.

What does Pfizer Inc do?

Pfizer Inc (PFE) is a global biopharmaceutical company that develops and produces vaccines, oncology therapies, and innovative medicines. It became widely known for its role in developing a COVID-19 vaccine.

Pfizer is headquartered in New York and serves markets across the USA and internationally. Its work covers many areas, including rare diseases, inflammation, and infectious diseases.

Who are the key executives at Pfizer Inc?

Pfizer Inc has a strong executive team, including Christoffel Boshoff (EVP & Chief Oncology Officer), Ronald E Blaylock (Director), Scott Gottlieb (Director), and Payal Sahni (Chief People Experience Officer). Each of these leaders brings valuable knowledge to the company.

Together, they drive Pfizer’s mission to deliver breakthroughs that change patients’ lives. Their leadership complements Shantanu Narayen’s strategic contributions on the board.

Pfizer Inc (PFE) Insider Trades Summary

Over the past year, Pfizer Inc has seen several notable insider trades. These include sales by Scott Gottlieb and purchases by internal directors. Form 4 reports confirm the legitimacy of these transactions.

Insider activity has remained moderate, showing stability and confidence in the firm’s future direction. The trades usually happen during earnings periods or major product announcements.

Pfizer Inc Insider Transactions

One recent transaction shows Payal Sahni buying 2,500 shares at a competitive price, which suggests confidence in the company’s stock value. Ronald E Blaylock also made a purchase earlier this year.

All insider transactions are public and help build transparency in the market. Investors look closely at these trades to understand how insiders view the company’s performance.

What does Adobe Inc do?

Adobe Inc (ADBE) is a global leader in creative software. It provides tools like Photoshop, Lightroom, Premiere Pro, and Adobe Acrobat. These platforms support creators, marketers, and businesses in producing digital content.

Adobe’s business model is largely subscription-based. This has helped maintain steady revenue, with high-profit margins and strong growth in cloud-based solutions.

Who are the key executives at Adobe Inc?

Adobe’s executive team includes Scott Belsky (Chief Product Officer), Daniel Durn (CFO), Mark S. Garfield (Corp Controller), and Jennifer B. Damico (Chief Accounting Officer). They work closely with Shantanu Narayen to shape product strategy and financial growth.

This team has been instrumental in Adobe’s expansion into AI, web publishing, and mobile content solutions. Their leadership keeps Adobe at the front of the creative software market.

Adobe Inc (ADBE) Insider Trades Summary

Recent insider trades at Adobe include scheduled sales by Shantanu Narayen and Scott Belsky. These have been consistent with previous years and follow Adobe’s strong quarterly earnings.

The company’s Form 4 reports show no unusual trading activity, which is often a sign of corporate stability. Investors use these summaries to gauge executive sentiment.

Adobe Inc Insider Transactions

Among the recent insider transactions, Scott Belsky sold 16,957 shares while Daniel Durn sold 23,457. These were scheduled sales and align with compensation structures.

Jennifer B. Damico and Mark S. Garfield also reported 15,803 shares sold collectively. The transactions were filed with the SEC and reflect ongoing compensation practices tied to Adobe’s stock performance.

Conclusion

In conclusion, Shantanu Narayen Net Worth reflects his long-term leadership at Adobe Inc and strategic involvement with Pfizer Inc. With over $137 million in estimated wealth, driven largely by Adobe stock, Narayen’s financial profile is a benchmark in executive success. His consistent insider trading activity, ownership transparency, and influential network highlight his steady rise in the tech and healthcare sectors. For investors and analysts alike, tracking Narayen’s holdings offers valuable insight into executive confidence and company performance over time.

Reach out for business queries.